The global business landscape in 2025 is defined by technology-driven efficiency, automation, and the constant demand for smarter financial tools. As enterprises grow more complex and interconnected, applications that help manage money, spending, and collaboration have become indispensable. Business owners and finance professionals no longer see apps as optional support systems but as essential infrastructures that power decision-making and strategy.

This article examines three of the most influential business and economy apps of 2025: QuickBooks Online, the comprehensive accounting hub trusted across industries; Xero, the cloud-native platform built for collaboration and scalability; and Ramp, a cutting-edge financial technology platform revolutionizing corporate expense management. Each of these apps represents a different pillar of modern finance: structured accounting, collaborative visibility, and AI-driven cost optimization. Together, they showcase the future of how companies will manage money in an era of digital-first economics.

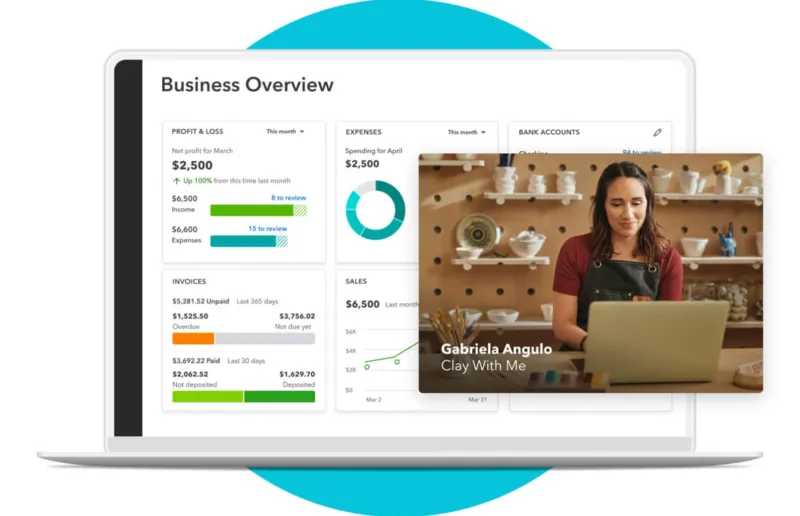

QuickBooks Online – The Comprehensive Accounting Powerhouse

Description (100 words)

QuickBooks Online remains one of the most widely used financial management platforms in 2025. Known for its versatility, it allows businesses to track income and expenses, generate invoices, run payroll, prepare taxes, and create financial reports all in one system. Its ecosystem integrates with over 650 third-party apps, ensuring compatibility with banking, e-commerce, and industry-specific solutions. Mobile accessibility ensures that executives and small business owners can make informed financial decisions anywhere. With user-friendly dashboards and customizable reporting, QuickBooks Online simplifies financial complexity and allows businesses to focus more on growth and less on administrative work.

In-Depth Analysis

QuickBooks Online is more than just software—it is often referred to as the backbone of small and medium-sized business finance. In 2025, its ability to adapt to changing tax codes, integrate AI-powered insights, and automate recurring tasks has reinforced its importance. Many companies use it as a daily control center for financial operations. The strength of QuickBooks lies not only in its functionality but also in its ability to democratize accounting knowledge. Even business owners with limited finance backgrounds can understand their numbers, forecast cash flow, and prepare for future growth. This accessibility explains why QuickBooks Online continues to hold a dominant market share, even as newer apps enter the field.

Xero – Cloud Accounting for Collaboration and Scale

Description (100 words)

Xero has emerged as a favorite among startups, freelancers, and growing enterprises in 2025. Its cloud-first architecture allows users to collaborate seamlessly with accountants, financial advisors, and internal teams in real time. Key features include multi-currency support, bank reconciliation, inventory management, and financial dashboards tailored for accessibility. The unlimited-user model makes it particularly appealing for companies that are scaling quickly. Xero also connects with hundreds of applications across payments, e-commerce, and payroll, making it a versatile tool. Its strength lies in simplicity: even users with minimal accounting knowledge can manage financial data efficiently.

In-Depth Analysis

Unlike QuickBooks, which often feels structured for accounting professionals, Xero thrives as a collaboration-first platform. Its design philosophy is focused on inclusivity and teamwork. In 2025, businesses increasingly demand visibility not just for executives but for cross-functional teams. Xero allows real-time collaboration where accountants, sales teams, and managers can all access the same data without confusion. This democratization of financial access accelerates decision-making and enhances accountability. Multi-currency support is another strength, reflecting the globalization of small businesses. From online retailers shipping worldwide to remote-first startups, Xero offers the scalability to adapt without losing simplicity. Its growing ecosystem positions it as a strong competitor to QuickBooks, particularly in the small-to-mid-tier enterprise segment.

Ramp – AI-Powered Expense Management and Smart Spending

Description (100 words)

Ramp has rapidly become a game-changer in business finance by focusing on expense management and intelligent corporate spending. The platform offers charge cards, automated bill payment, and real-time expense tracking. Unlike traditional credit systems, Ramp uses AI and automation to detect inefficiencies, enforce policy compliance, and recommend savings opportunities. By 2025, Ramp processes tens of billions in annual payments for thousands of companies. Its appeal lies in reducing wasteful spending, streamlining reimbursement workflows, and providing CFOs with insights into financial health at a glance. Ramp has quickly grown into a leading choice for businesses that prioritize efficiency and strategic control.

In-Depth Analysis

Ramp is a clear example of how artificial intelligence is shaping the future of finance. Its platform does not simply record expenses—it analyzes them, creating actionable insights for cost reduction. For companies navigating inflation, fluctuating supply chains, or complex project budgets, this intelligence is invaluable. In 2025, Ramp has gained popularity among high-growth startups and mid-market firms that need agility and visibility. Another reason for its success is its focus on user experience. Unlike legacy systems that often feel outdated, Ramp is sleek, fast, and mobile-first, aligning with how modern executives manage operations. Ramp’s ability to combine expense management with financial strategy sets it apart in the fintech space.

Comparative Perspective

The three apps highlighted—QuickBooks Online, Xero, and Ramp—reflect different but complementary financial priorities:

- QuickBooks Online excels at being the all-in-one accounting hub. It is ideal for businesses seeking a comprehensive solution with wide industry applicability.

- Xero emphasizes collaboration, scalability, and accessibility. It is well-suited for globalized businesses and startups needing teamwork and cloud-first functionality.

- Ramp represents the innovative edge of fintech by focusing on AI-driven expense management and real-time insights. It is essential for companies seeking to optimize budgets and eliminate inefficiencies.

Together, they form a trinity of tools that cover the core financial needs of modern businesses: structured accounting, collaborative visibility, and strategic spending intelligence.

Broader Context – Why These Apps Matter in 2025

The rise of these apps is not just about convenience; it reflects deeper shifts in the business landscape:

- Globalization of Small Business – Companies of all sizes now operate internationally, demanding multi-currency support, real-time collaboration, and scalable financial tools.

- AI and Automation – Businesses no longer tolerate manual entry and outdated spreadsheets. Ramp and QuickBooks now provide AI-driven recommendations and automated workflows.

- Financial Democratization – Tools like Xero are breaking down barriers, making financial management accessible even to those without professional training.

- Agility and Transparency – Modern businesses value speed and clarity in decision-making. These apps offer instant data access, ensuring that leaders act quickly and with confidence.

Conclusion

The business and economy apps of 2025 represent more than just software. They are enablers of growth, collaboration, and efficiency. QuickBooks Online continues to dominate with its robust, all-in-one functionality. Xero stands out for making financial collaboration and scalability easier than ever. Ramp showcases the future with its AI-driven approach to spending and expense management.

In combination, these platforms illustrate the direction of business technology in the mid-2020s: smarter automation, global accessibility, and strategic financial intelligence. For businesses navigating uncertainty and competition, these tools are no longer optional—they are essential weapons for survival and growth in the digital economy.